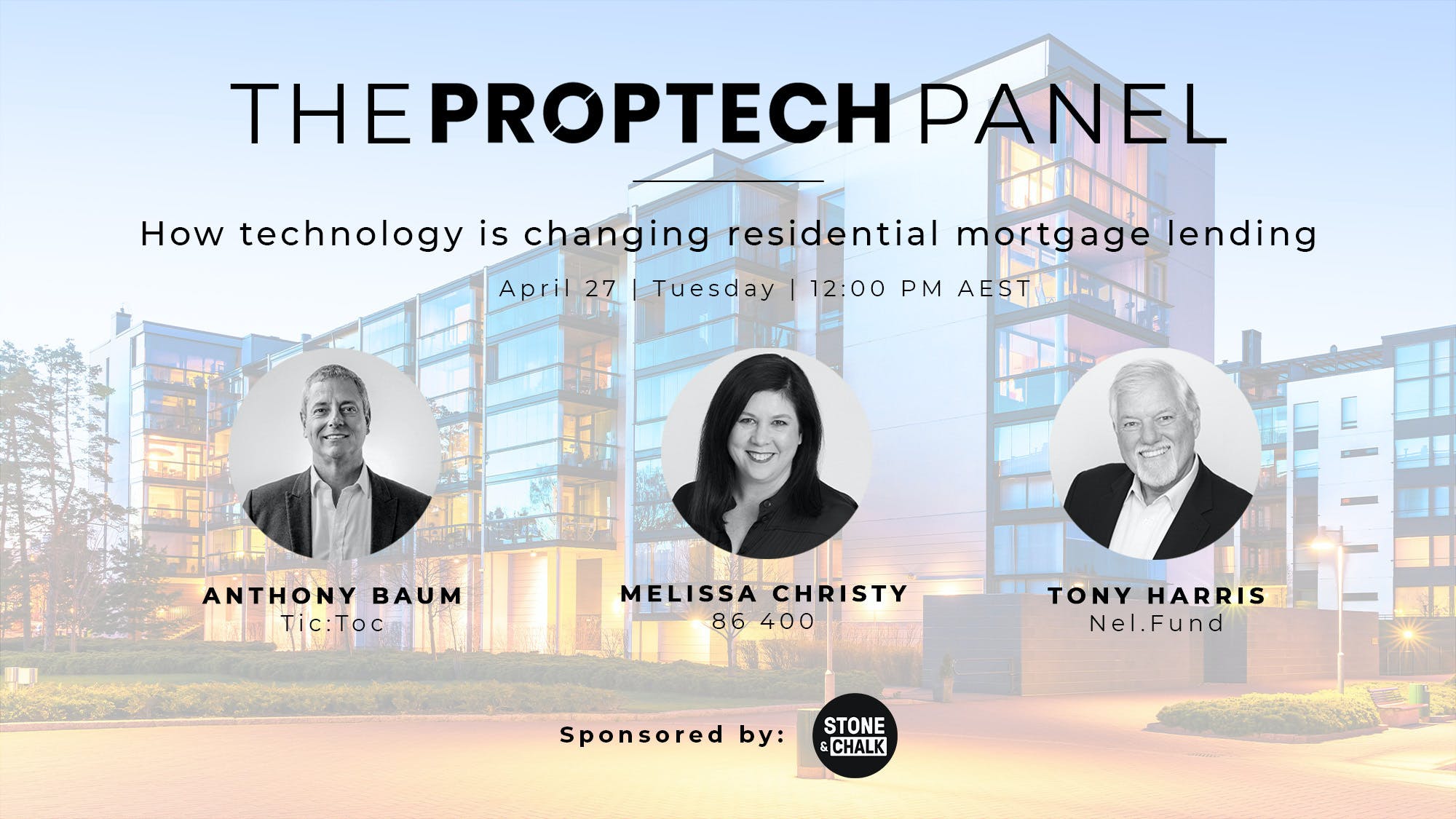

The digitisation of residential mortgage lending is well underway thanks to the rapidly expanding Proptech industry. We are joined by three passionate proptech entrepreneurs who are busy disrupting the traditional home loan application process:

Anthony Baum, Founder & CEO at Tic:Toc

Melissa Christy, Lending Product Lead at 86 400

Tony Harris, Co-Founder & CEO at Nel.fund

The session was hosted by Jennifer Harrison, Vice President of Proptech Association Australia.

Jennifer recalls her own tedious experience of applying for a mortgage, describing the process as “manual, archaic and quite frankly brutal”. In the first meeting she was asked to provide screenshots for proof of deposit and three months of printed credit card statements – from her own bank.

Give us an ‘elevator pitch’ introduction to your business

Tic:Toc is a home loan platform providing a simplified digital home loan experience, and, as a SaaS product, is in the process of making its technology available to the industry. The name is a nod to time saving. “By automating and digitising the process we are giving time back to the customer, and to ourselves”, Anthony explains. Their fastest end-to-end home loan application took just 58 minutes.

Melissa describes 86 400 as Australia’s first smart bank, providing customers a single platform on which to control their entire financial world. They also offer digital home loans, using data for customer information instead of paperwork: “For a purchase all we need is a contract of sale”. The name also derives from time: “It is the number of seconds in a day… we help customers control their money every second of every day”.

Nel.fund (Nest Egg Living), a current Stone & Chalk resident, aims to unlock home ownership for more Australians by providing ‘co-funded’ special-purpose loans to clients who, despite earning good salaries, are unable to save adequate deposits. The loans are secondary to the mortgage, Tony explains, meaning that the company has a vested interest. “That’s why we take the time upfront to help with the process and property selection”.

How is the industry reacting?

For 86 400, securing buy-in from brokers and aggregators has been a long process. While many brokers recognise the advantages of a purely digital approach, others remain vehemently attached to traditional paper based methods. The same is true for a segment of customers, who are averse to a digital scraping of their finances.

Anthony has had a similar experience in his discussion with banks, including the Big Four. While they are starting to recognise the need to collaborate with Fintechs, there is still a build-bias. “It will take time, but it will happen, especially as success stories increase”.

For Tony and Nel.fund, the crucial first-step is securing the confidence of mortgage providers by showcasing their use of data and AI to financially validate clients and match them with viable properties.

Are there any concerns regarding compliance?

In Anthony’s opinion, technology with human-in-the-loop actually provides better compliance with policy: “Compliance can be more consistently applied when technology is extensively leveraged. Humans forget to do things. Technology does not.”

Melissa agrees, explaining that traditional lenders rely on customers declaring what they spend. 86 400 on the other hand, scrapes customers’ accounts from all financial institutions and presents it back to them. “We start from fact and work forwards from there”.

Our panellists all see the future of mortgage applications as a streamlined and digital process. Jennifer sums up this sentiment: “As the smartphone takes care of more and more things in our lives, it makes sense that we will be getting a mortgage within minutes from our phone.”